As a parent or guardian of a child performer, you want to make sure that your child's earnings are secure and protected. That's where a Child Performer Trust Account comes in. This type of account is specifically designed to safeguard the money earned by child performers and ensure that it is used for the child's benefit.

What is a Child Performer Trust Account?

A Child Performer Trust Account is a legal arrangement between the performer's parent or guardian and a financial institution. The account is opened in the child's name and all earnings from performances are deposited into it. The money in the account is then managed by a trustee, who is responsible for making sure that it is used for the child's benefit.

Child Performer Trust Accounts are required by law in many states and countries. They are designed to protect child performers from exploitation and ensure that their earnings are used wisely.

Why is a Child Performer Trust Account Important?

There are several reasons why a Child Performer Trust Account is important:

- Protecting the child's earnings: The money earned by child performers is often significant, and it is important to ensure that it is not misused or stolen.

- Ensuring that the money is used for the child's benefit: The trustee is responsible for managing the money in the account and making sure that it is used for the child's education, health, and other needs.

- Complying with legal requirements: In many states and countries, Child Performer Trust Accounts are required by law. Failure to set up an account can result in fines or other penalties.

How Does a Child Performer Trust Account Work?

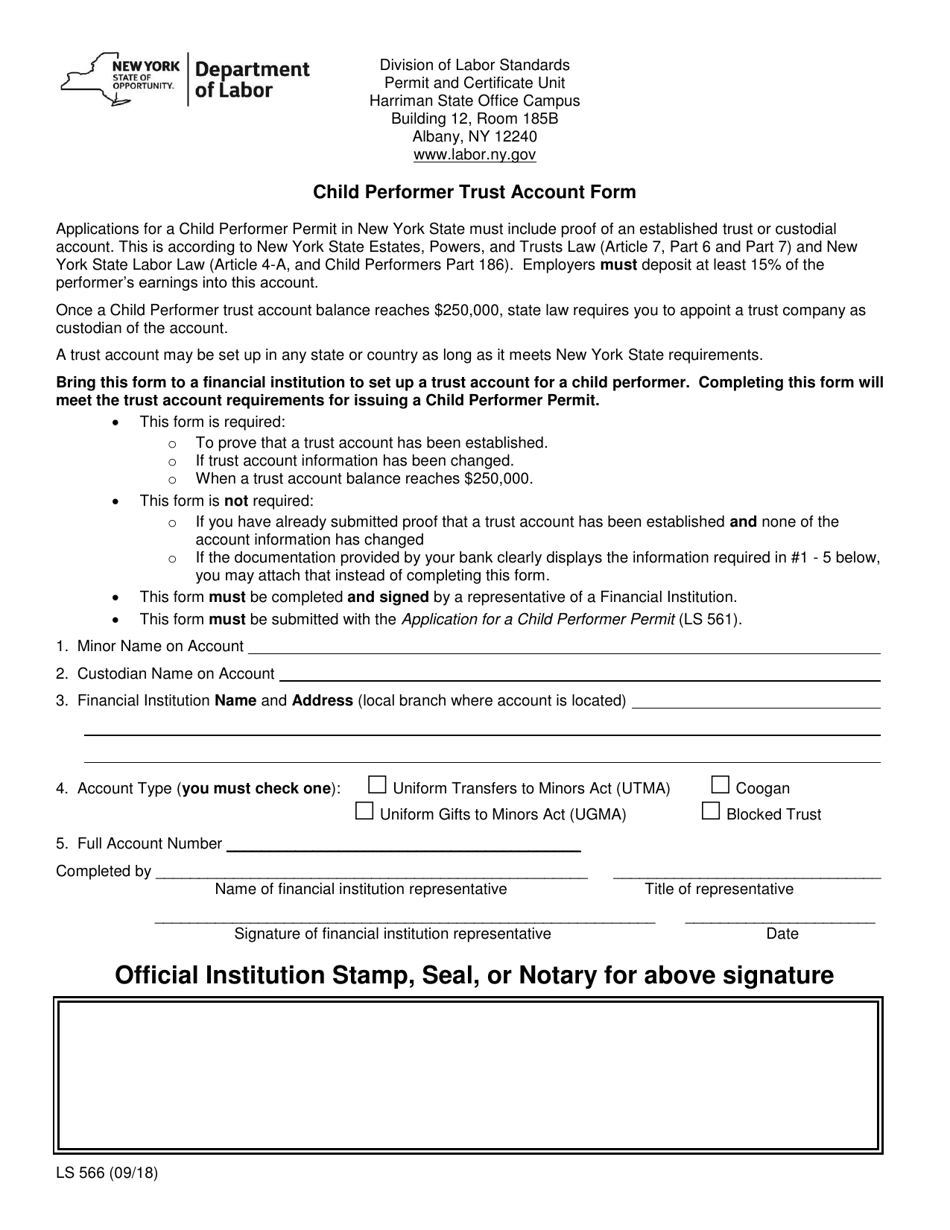

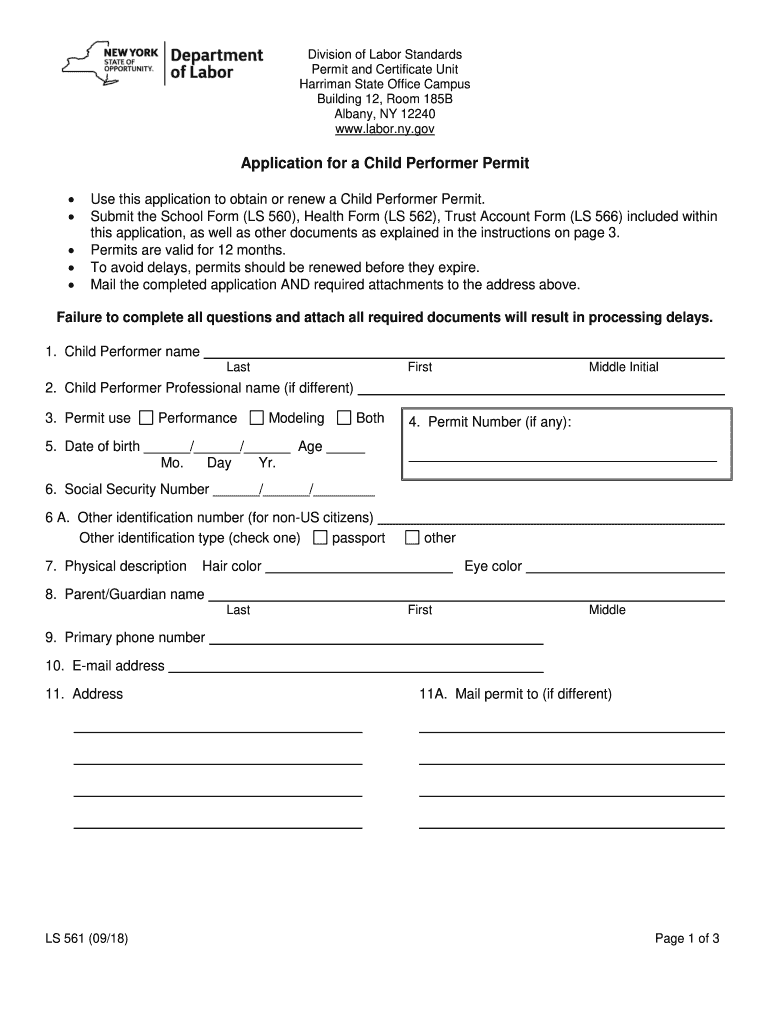

Setting up a Child Performer Trust Account is a straightforward process:

- Choose a financial institution: You will need to choose a bank or other financial institution to open the account. Make sure that the institution is reputable and has experience in managing trust accounts.

- Complete the paperwork: You will need to fill out the necessary paperwork to open the account. This will include information about the child performer, the trustee, and the account itself.

- Deposit earnings: Once the account is set up, all earnings from performances should be deposited into it.

- Manage the account: The trustee is responsible for managing the money in the account and making sure that it is used for the child's benefit.

Who Can Serve as a Trustee?

The trustee is responsible for managing the money in the Child Performer Trust Account. This person should be someone who is trustworthy and has experience in managing finances. The trustee can be:

- A parent or guardian: If the parent or guardian is financially responsible and has experience in managing money, they can serve as the trustee.

- A financial professional: A financial planner or other professional with experience in managing trust accounts can also serve as the trustee.

- A court-appointed guardian: In some cases, a court-appointed guardian may be required to serve as the trustee.

What Happens to the Money in the Account?

The money in the Child Performer Trust Account is used for the child's benefit. This can include:

- Education: The money can be used to pay for the child's education, including tuition, books, and other expenses.

- Healthcare: The money can be used to pay for the child's healthcare needs, including medical bills, prescriptions, and insurance premiums.

- Other expenses: The money can also be used to pay for other expenses related to the child's well-being, such as housing, food, and clothing.

The trustee is responsible for managing the money in the account and making sure that it is used for the child's benefit. The trustee is required to keep detailed records of all transactions and provide regular reports to the parent or guardian.

Conclusion

A Child Performer Trust Account is an important tool for protecting the earnings of child performers and ensuring that the money is used for their benefit. By setting up a trust account, parents and guardians can have peace of mind knowing that their child's earnings are secure and will be used wisely.